Some contractors will pay sales tax only on goods that they can use multiple times. For example, they will not pay tax on paint (because it gets applied to a job and cannot be re-used), but they will pay tax on the sprayer they used to apply that paint (because they can continue to use it again and again).

Why? The primary reason for this is that the contractor serves end customers that are tax-exempt. For example, they may be painting a government or religious building.

So how can we handle these customers in Rundoo? We recently launched a feature to make it easier!

Before: Two transactions

Before, our clients would have to process these as two transactions: one with tax and one without.

While this may not seem that bad, it required clerks to know which customers and which products deserved single-use taxation. It was very error prone! 🤮

Now: Single-use taxation

You can now set this up automatically.

Step 1: Set products to be single-use taxable

Mark the products that are single-use taxable.

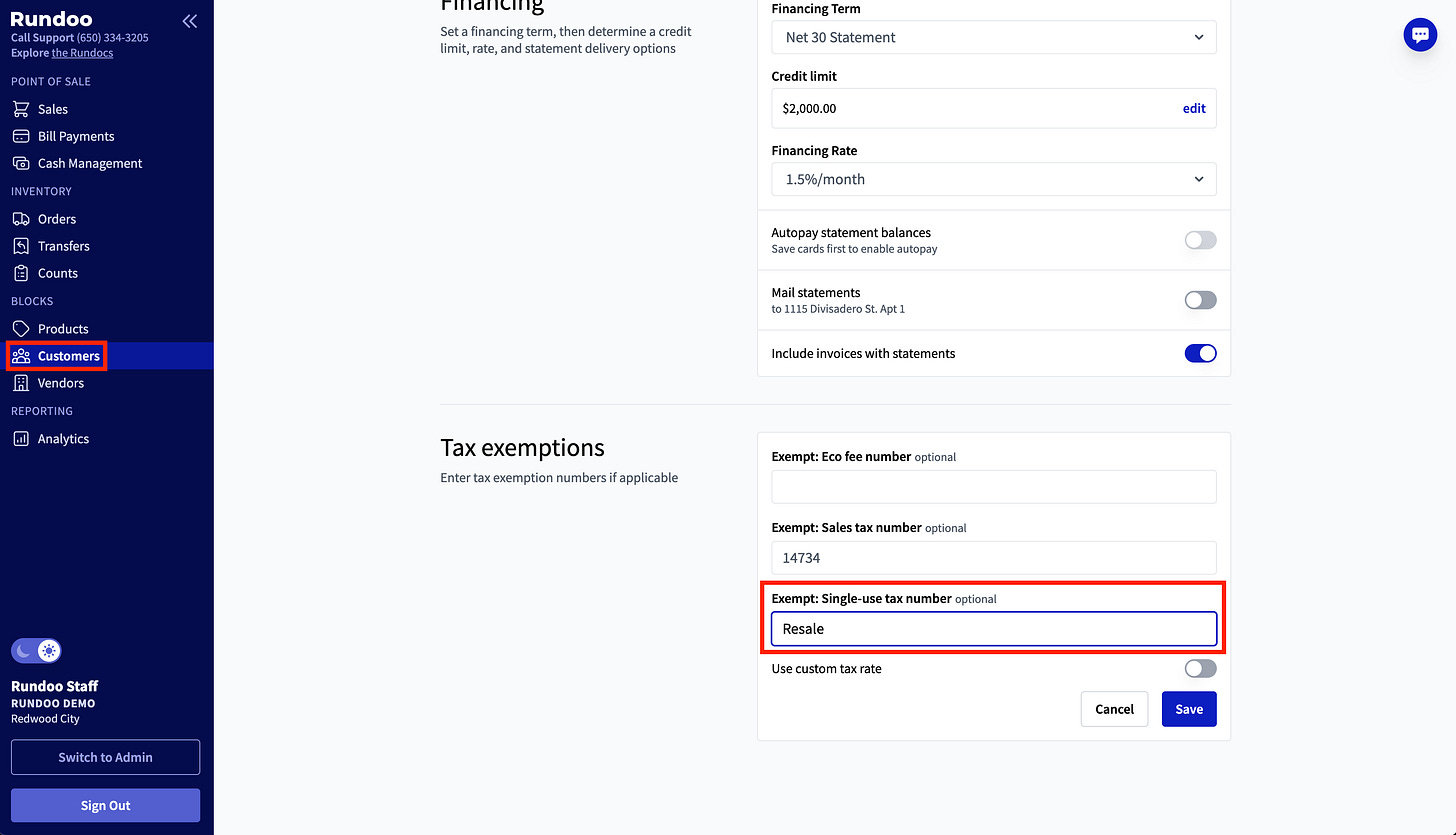

Step 2: Set customers to be single-use tax exempt

Mark customers as single-use tax exempt. Ideally, your customers give you their verification number for single-use taxation. If they don’t, you can type anything in this box, and Rundoo will mark them as single-use tax exempt.

Step 3: Process a sale

Now, when you add that customer and product to a sale, no tax will be applied for that product.

What next?

That’s it! If you need help changing a bunch of data in bulk, reach out to support.

👋