Cash management: what are best practices to ensure my business is not losing money?

Why does this article matter?

Tracking the cash in your registers ensures you catch any theft or errors that may be causing losses in your business.

What are some key concepts?

Cash management is tracking the changes each day from your float, the amount of cash that you start each day with in the cash register. During your course of business, four types of transactions can affect the cash in the cash register:

Cash sales & refunds: Customers paying for items in cash or returning goods from a purchase they originally made in cash.

Bill payments in cash: Charge account customers paying down their balance in cash.

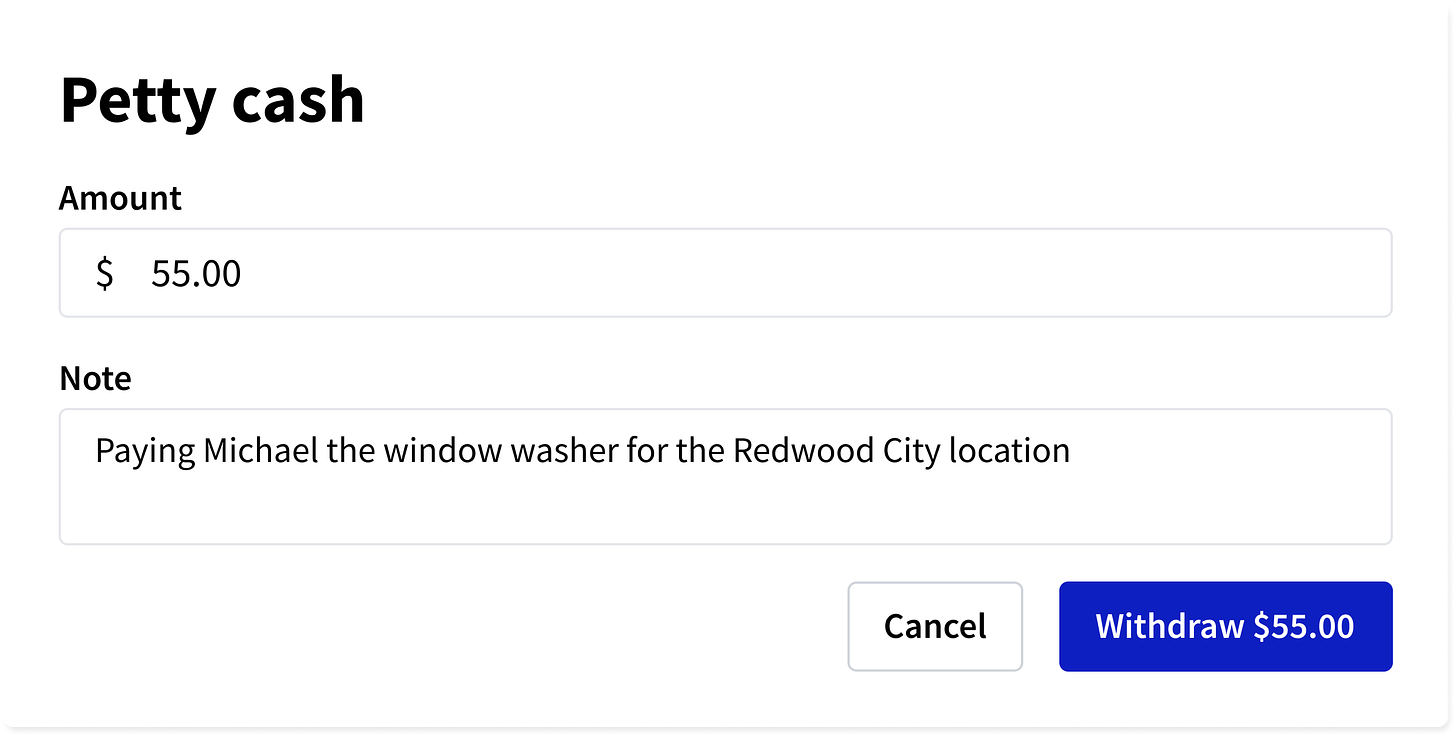

Petty cash withdrawals: Employees paying for business expenses, such as a maintenance person or lunch, using cash in the register.

Note that some paint stores do not allow employees to do this. If it is plausible for your business to not allow this—perhaps because you don’t have any vendors that take only cash—we recommend you avoid it. Allowing petty cash withdrawals can become another point of failure.

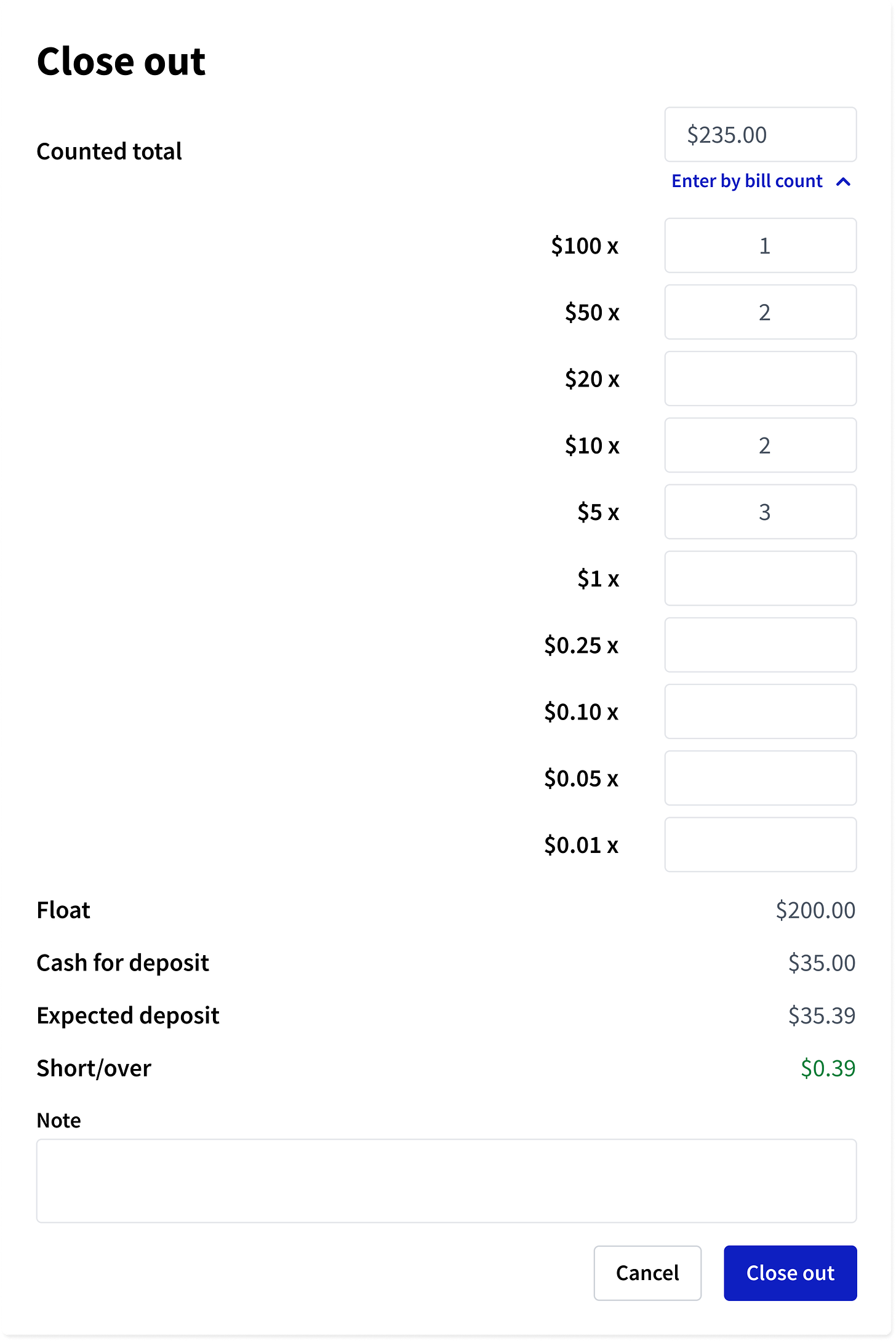

Closing out: At the end of the day, removing all cash in excess of your float for deposit in your bank.

What have we seen as best practice for paint stores handling this?

The key to effective cash management is (1) good data in and (2) frequent review.

Good data in:

Tracking cash sales & refunds, bill payments in cash, and petty cash withdrawals: it’s important that your POS system tracks the data behind each one of these transactions, so that you can access this data later to see if there’s anything odd going on. For example, if one of your employees does a petty cash withdrawal, the system should automatically track the name of the employee withdrawing the petty cash, the total dollar amount withdrawn, and the reason for the petty cash withdrawal. We’ve found most owners require the employee keep the receipt as well.

💡💡 Closing out 💡💡 this is where we have seen most paint stores can improve their operations. The big idea is tracking how much you count in the cash register each day (ie, #4 above). Whether or not you input the count of each bill and coin, tracking the total cash amount in the register lets you track and eventually spot any discrepancies between the cash that should have been taken out each day versus what actually has been taken out.

Frequent review:

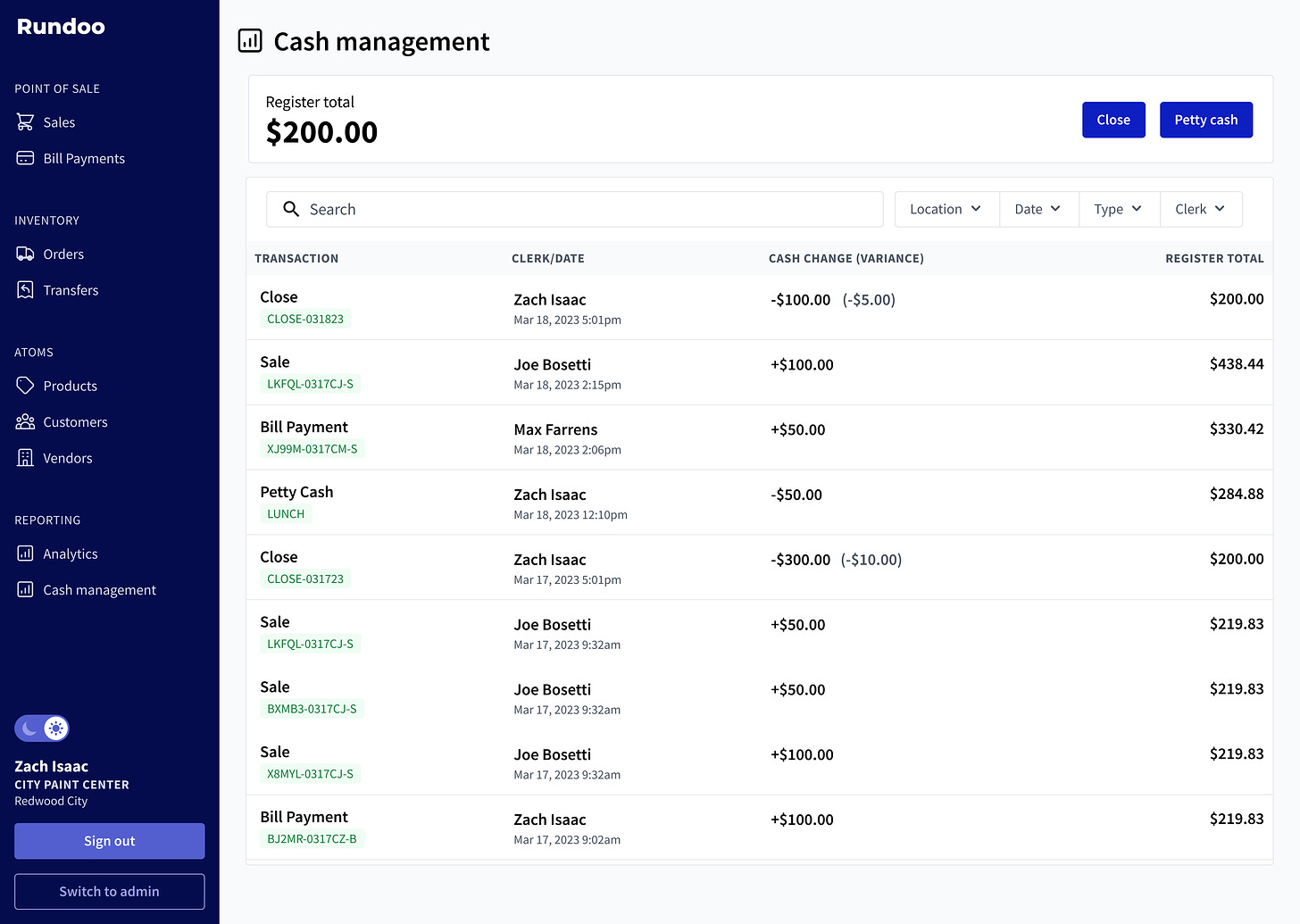

Review all transactions: Now that you’ve put all the hard work in, you can look for anything odd. The big idea here is having a place where you can review all transactions that affect the cash register. Most specific issues are found by looking at the variance, the difference between what should be in the register and what is entered at close.

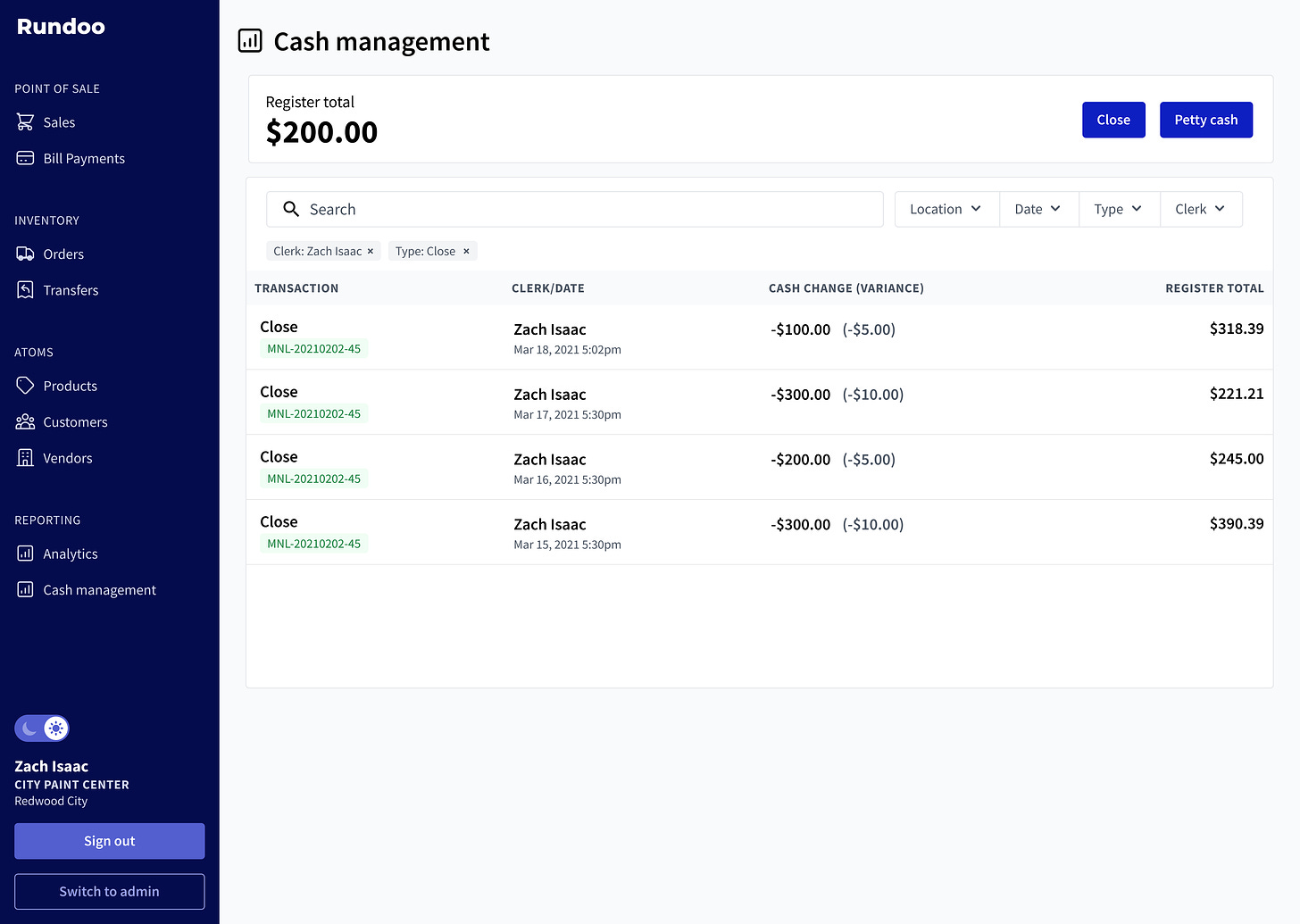

Filtering and search on transactions: Use search and filters to further investigate any discrepancies. For example, you could filter to all closes by a particular employee (eg, “Clerk: Zach Isaac”, “Type: Close”). Perhaps you’ll see that this employee is consistently off by a few dollars, indicating there may be theft going on.

What are the next steps here?

If you want to learn more about how Rundoo handles this or want help setting up ways to track your cash transactions, book a time here or shoot me an email at joe@getrundoo.com — I’m happy to chat!